Legislative Update: County-by-county filing dates following Hurricane Helene

October 03, 2024

By FICPA Governmental Affairs

On Sept. 26, Hurricane Helene made landfall in the Big Bend area of Florida, causing massive wind damage, storm surge and flooding across the state.

Gov. Ron DeSantis declared a state of emergency for 61 Florida counties in advance of the storm, and the White House later approved a Major Disaster Declaration for the 17 hit hardest by Helene.

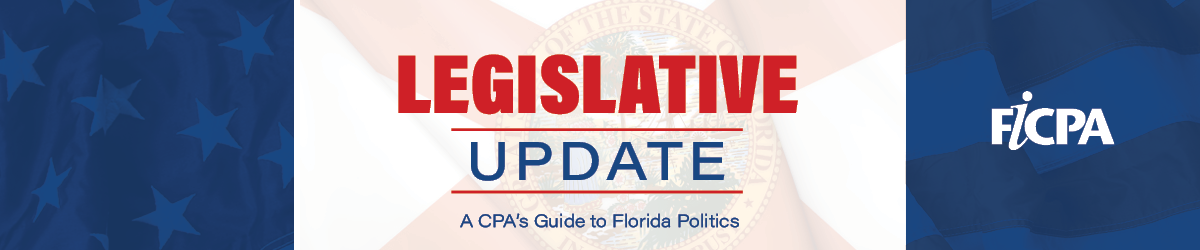

On Tuesday of this week, the Internal Revenue Service issued filing relief to May 1, 2025, for the following 41 counties: Alachua, Bay, Bradford, Calhoun, Charlotte, Citrus, Collier, Columbia, Dixie, Escambia, Franklin, Gadsden, Gilchrist, Gulf, Hamilton, Hernando, Hillsborough, Holmes, Jackson, Jefferson, Lafayette, Lee, Leon, Levy, Liberty, Madison, Manatee, Marion, Monroe, Okaloosa, Pasco, Pinellas, Santa Rosa, Sarasota, Sumter, Suwannee, Taylor, Union, Wakulla, Walton, and Washington.

We have been in close communication with the IRS in recent days. IRS officials have confirmed that the 20 counties who were previously issued relief following Hurricane Debby - Baker, Brevard, Clay, DeSoto, Duval, Flagler, Glades, Hardee, Hendry, Highlands, Lake, Nassau, Okeechobee, Orange, Osceola, Polk, Putnam, Seminole, St. Johns, Volusia - are not included in the Helene extension and still have effective due dates of Feb. 3, 2025. Following our inquiry, the IRS updated its notice to provide additional clarity as to which counties are included in the Helene extension.

We have created the map below for your reference.

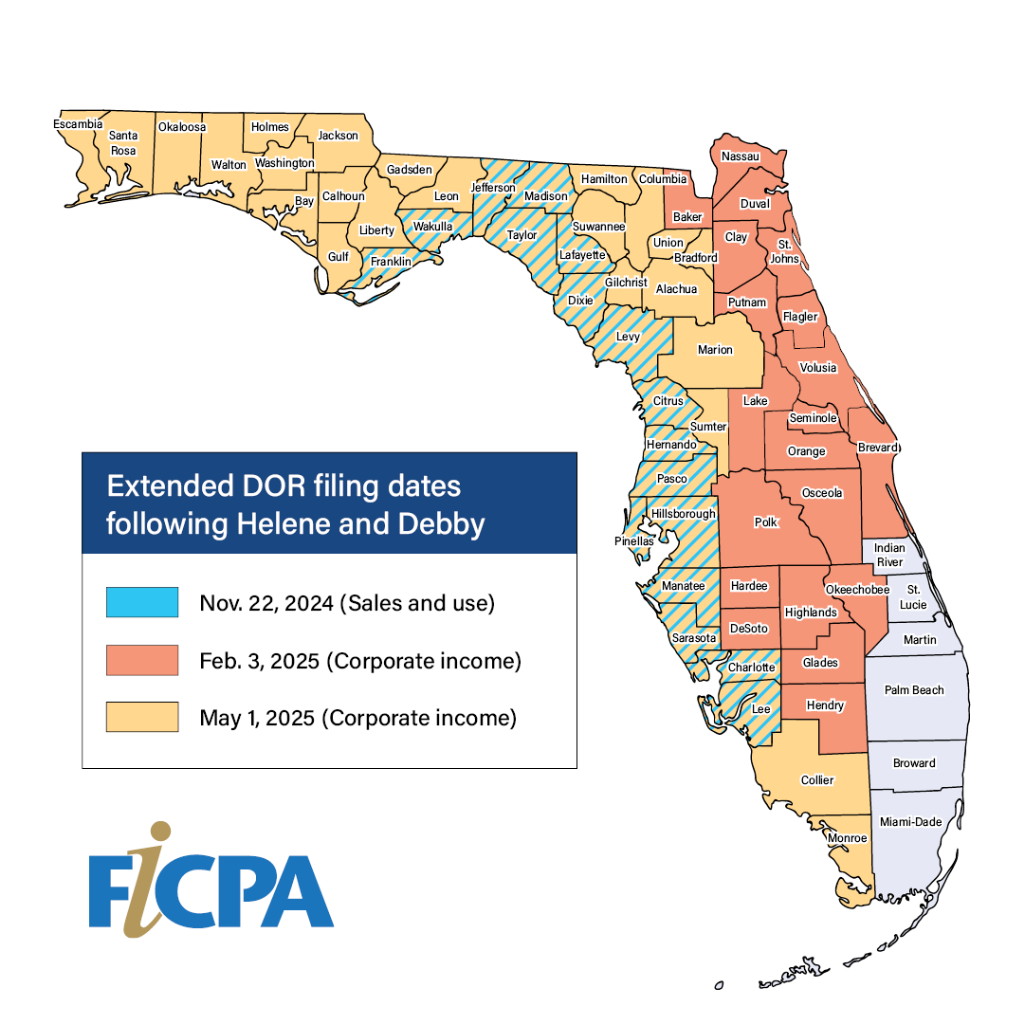

Following the relief provided by the IRS, the Florida Department of Revenue on Wednesday issued its own corporate income/franchise tax extension to May 16, 2025, for the 41 counties named above. The Department separately issued Emergency Order #24-002, extending "September 2024 and October 2024 reporting periods for sales and use tax, reemployment tax, and several other tax types to November 22, 2024, for the 17 counties in Florida where Hurricane Helene made landfall: Charlotte, Citrus, Dixie, Franklin, Hernando, Hillsborough, Jefferson, Lafayette, Lee, Levy, Madison, Manatee, Pasco, Pinellas, Sarasota, Taylor, and Wakulla." The FICPA had previously issued a letter to DOR Executive Director Dr. Jim Zingale asking for all applicable relief for affected taxpayers.

We have again created a map for your convenience.

In addition to our communication with the IRS and DOR, we have also issued a letter to the U.S. Treasury's Financial Crimes Enforcement Network, requesting extensions for affected Floridians who have Report of Foreign Bank or Financial Accounts (FBAR) and/or beneficial ownership information (BOI) filing requirements.

Rest assured, we will continue to advocate for our members across the state and provide guidance as available. We encourage you to check our Hurricane Helene news and resource page for further updates.

Replay: Hurricane Helene Recovery Webinar

On Thursday, Oct. 3, we presented a "Hurricane Helene Recovery Matters" webinar, featuring nationally renowned disaster-relief expert Gerard Schreiber and FICPA Board member Mindy Rankin.

The FICPA hosted the virtual event, which was also made available to members of the Georgia, South Carolina, North Carolina, Tennessee and Virginia state societies.

Jerry and Mindy walked through the relevant filing dates, addressed pertinent legislation and answered questions from the chat throughout the session.

If you could not be on the call, or would like to revisit this important information, you can watch the full replay here.

Jerry Schreiber will also be returning for a second disaster recovery webinar on Wednesday, Oct. 23. Sign up now!

(Note: The replay does not qualify for CPE credit.)

Successful Advocacy Events Held Throughout Florida

Over the past two weeks, we hosted three FICPA Days in Jacksonville, Miami, and Tampa. These events included Office Managing Partner Roundtables, Florida CPA/PAC luncheons, advocacy-focused FICPA Town Halls and FICPA Scholarship Foundation Scholar's Achievement Receptions.

The three CPA/PAC luncheons featured polling insights from a pair of key political insiders. Alex Coelho of the Florida Chamber of Commerce and Ray Walker of the University of North Florida offered the inside scoop on what to expect in Florida on election night, from top-of-the-ticket federal races to local battleground seats and constitutional amendments. The CPA/PAC is proud to enhance the benefits its supporters receive.

Chief External Affairs Officer Jason Harrell and President & CEO Shelly Weir presided over the Town Halls, reviewing Florida's 2024 Legislative Session, looking ahead to 2025, and offering an timely regulatory update.

All three FICPA Days were well-attended and provided a wonderful opportunity for our members to attend multiple FICPA events in one day at one location.

We'd also like to extend a special thank you to one of our valued CPA Lawmakers, Sen. Joe Gruters (pictured above), for joining us in Miami, and to all the OMPs pictured below!

Brevard Chapter Event

Last week, Jason Harrell presented a legislative update to the FICPA's Brevard Chapter. Harrell reviewed the 2024 Legislative Session and the bills of most interest to the profession. Harrell also highlighted the legislative approach the Governmental Affairs Team uses to ensure the profession is covered from every angle. By combining a public affairs strategy with a strong advocacy team, the FICPA has a robust political arm. Many thanks to Brevard Chapter President Randy Coleman for the invite and to all the FICPA members who attended.

Countdown to Election Day

We're just a month away from Election Day. Floridians are sure to be on the receiving end of political mailers and television ads morning, noon and night. The last 30 days of the election can be chaotic and hard to follow, but the FICPA Governmental Affairs Team has you covered.

We invite you to join us on Nov. 12, for a post-election Town Hall, recapping the results most important to our members.